[ad_1]

Banks are teetering as clients yank their deposits. Markets are seesawing as traders scurry towards security. Regulators are scrambling after years of complacency.

Fifteen years in the past, the world careened right into a devastating monetary disaster, precipitated by the collapse of the American housing market. In the present day, a special wrongdoer is stressing the monetary system: quickly rising rates of interest.

The sudden collapses of Silicon Valley Financial institution and Signature Financial institution — the biggest bank failures because the Nice Recession — have put the precariousness of lenders in stark reduction. First Republic Financial institution was compelled to hunt a lifeline this week, receiving tens of billions of {dollars} from different banks. And fears in regards to the stability of the banking system hit Credit score Suisse, the battered European large.

However the storm had been quietly constructing for months.

The shakiness of some banks will be traced to how they basically work.

The best means to consider a financial institution is that it takes deposits from clients and lends these funds to individuals who wish to purchase a home or to corporations hoping to construct a manufacturing unit. The truth, although, is extra difficult.

A diagram of a hypothetical financial institution that experiences a financial institution run.

A hypothetical financial institution . . .

Receives $2 billion in

deposits from its clients.

It then invests that cash:

$1 billion in loans it offers

out; $1 billion in bonds.

When curiosity

charges rise,

newer bonds

pay out extra.

Older bonds are much less engaging

to patrons and grow to be price much less:

The bonds the financial institution has at the moment are

price $500 million.

The financial institution now has solely $1.5 billion in

belongings — far lower than what was

initially deposited. If sufficient clients

ask for his or her a refund, the financial institution could

not find a way return all of the funds.

The extra individuals discover this, the

extra they demand their cash

again, making a run on the financial institution.

That’s what occurred with Silicon Valley Financial institution, which regulators seized on March 10 and which traders instantly seen as a doable harbinger of comparable bother at different banks.

The issue for SVB was that it held many bonds that have been purchased again when rates of interest have been low. Over the previous yr, the Federal Reserve has raised interest rates eight instances to fight the best inflation in generations. As charges went up, newer variations of bonds turned extra precious to traders than these SVB was holding.

With the tech trade cooling, a few of SVB’s clients started withdrawing their cash. To provide you with the money to repay depositors, SVB offered $21 billion of bonds. The financial institution racked up practically $2 billion in losses.

These losses set off alarms with traders and among the financial institution’s clients. If the remainder of SVB’s stability sheet was riddled with related money-losing belongings, would the financial institution have the ability to provide you with sufficient cash to repay its depositors?

Quite than wait round to seek out out, clients rushed to withdraw their funds – tens of billions of {dollars}.

A traditional financial institution run was underway.

“With the Fed enterprise essentially the most aggressive financial tightening over the previous 40 years, it appeared a matter of time till one thing broke,” analysts at Macquarie Securities wrote on Friday.

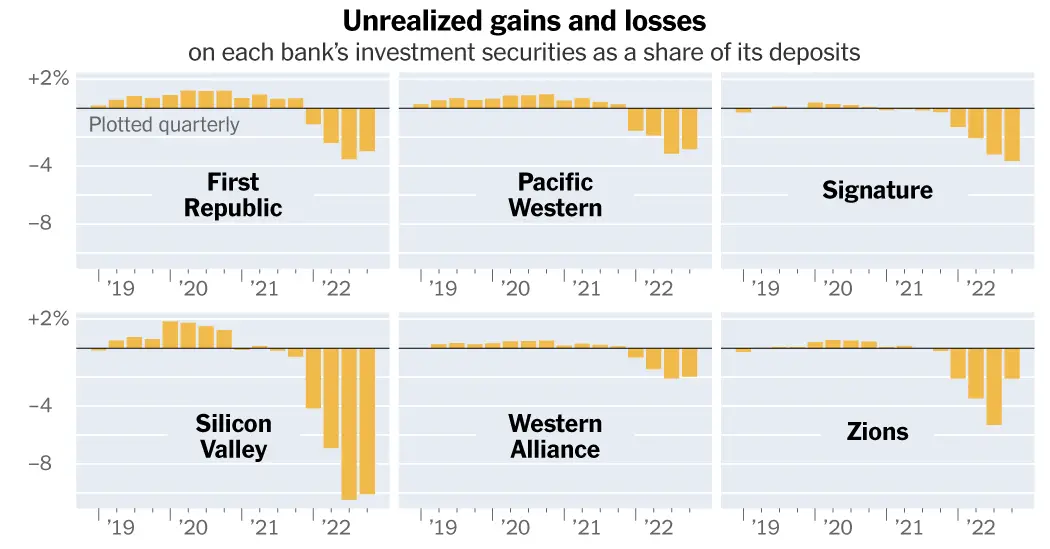

Even earlier than SVB capsized, traders have been racing to determine which different banks could be prone to related spirals. One shiny crimson flag: giant losses in a financial institution’s bond portfolios. These are often known as unrealized losses — they flip into actual losses provided that the banks need to promote the belongings.

For the reason that Fed started elevating rates of interest, banks have confronted rising unrealized losses.

These unrealized losses are particularly notable as a proportion of a financial institution’s deposits — an important metric, since extra losses imply a better probability of a financial institution struggling to repay its clients.

Unrealized features and losses

on every financial institution’s funding securities as a share of its deposits

A collection of bar charts exhibiting the unrealized features and losses on funding securities as a share of deposits for six mid-size banks from 2019 to 2022: First Republic, Pacific Western, Signature, Silicon Valley, Western Alliance and Zions. In every quarter of 2022, all banks had unrealized losses.

Supply: Federal Monetary Establishments Examination Council

Be aware: Contains each “held-to-maturity” and “available-for-sale” securities, that means each long- and short-term investments.

On the finish of final yr U.S. banks have been going through greater than $600 billion of unrealized losses due to rising charges, federal regulators estimated.

These losses had the potential to chew by means of greater than one-third of banks’ so-called capital buffers, which are supposed to defend depositors from losses, in accordance with Fitch Rankings. The thinner a financial institution’s capital buffers, the better its clients’ threat of shedding cash and the extra doubtless traders and clients are to flee.

However the $600 billion determine, which accounted for a restricted set of a financial institution’s belongings, may understate the severity of the trade’s potential losses. This week alone, two separate teams of teachers released papers estimating that banks have been going through no less than $1.7 trillion in potential losses.

Probably the most skittish financial institution clients are usually these whose deposits are uninsured.

This was an enormous drawback at SVB, the place greater than 90 % of the deposits exceeded the quantities lined below federal insurance coverage. The Federal Deposit Insurance coverage Company insures deposits for particular person accounts as much as $250,000, and plenty of different banks even have elevated ranges.

High 50 banks by share of deposits that aren’t insured by the F.D.I.C.

Excludes banking giants thought-about systemically necessary

A bar chart exhibiting the share of deposits that weren’t federally insured at 50 U.S. banks as of the tip of final yr. At each Silicon Valley Financial institution and Signature Financial institution, greater than 90 % of deposits have been uninsured.

Larger share of deposits uninsured

94% of $161 billion complete deposits

Bar heights are proportional to every financial institution’s complete home deposits

Larger share of deposits uninsured

94% of $161 billion complete deposits

Bar heights are proportional to every financial institution’s complete home deposits

Sources: Federal Monetary Establishments Examination Council; Monetary Stability Board

Notes: Information is as of Dec. 31, 2022. Contains home deposits solely. Excludes global systemically important banks, that are topic to extra stringent laws, together with harder capital necessities.

To make issues worse, many banks — particularly these with $50 billion to $250 billion in belongings — stored lower than 4 % of their belongings within the type of money, in accordance with Fitch.

Banks with much less money available could also be extra prone to bear losses if there’s a rush of withdrawals.

Six bar charts exhibiting the whole amount of money and noncash belongings held by midsize banks from 2019 to 2022: First Republic, Pacific Western, Signature, Silicon Valley, Western Alliance and Zions. At the same time as their belongings have climbed, these banks have held solely a small share in money.

Banks’ money and noncash belongings

Banks’ money and noncash belongings

Supply: Federal Monetary Establishments Examination Council

Midsize banks like SVB do not have the identical regulatory oversight because the nation’s greatest banks, who, amongst different provisions, are topic to harder necessities to have a specific amount of reserves in moments of disaster.

However no financial institution is totally resistant to a run.

“I don’t assume anyone’s constructed to face up to 25 % of their deposits leaving in a day, which is what occurred” within the case of SVB, mentioned Nathan Stovall, a banking analyst at S&P World Market Intelligence.

The Federal Reserve and different regulators are dashing to reassure everybody. Final weekend, the Fed announced a program that provides loans of as much as one yr to banks utilizing the banks’ authorities bonds and sure different belongings as collateral.

Crucially, the Fed mentioned it might worth the bonds at their unique worth — not on the decrease ranges that banks stood to obtain in the event that they tried to rapidly promote them within the markets. The Fed’s objective was to ship a reassuring sign that banks wouldn’t have to remodel unrealized, potential losses into crippling precise ones.

A minimum of up to now, that program hasn’t been a lot of a sport changer. Banks borrowed solely about $12 billion — a small fraction of the deposits that have been pulled out of SVB alone earlier than its implosion.

However banks wolfed up a whopping $153 billion in loans by means of the Fed’s conventional lending program. That was up from lower than $5 billion per week earlier and was the biggest quantity borrowed in per week because the 2008 monetary disaster.

The fright that started with SVB has continued to unfold to different banks.

On Wednesday, the Swiss authorities vowed to guard the enormous financial institution Credit score Suisse as issues about its stability swirled. The subsequent day, the U.S. authorities helped set up an trade bailout of First Republic — one of many giant banks that had attracted explicit consideration from nervous traders.

The troubles lurking within the stability sheets of small banks may have a large effect on the economy. The banks may change their lending requirements with a view to shore up their funds, making it more durable for an individual to take out a mortgage or a enterprise to get a mortgage to broaden.

Analysts at Goldman imagine that this may have the identical influence as a Fed rate of interest improve of as much as half some extent. Economists have been debating whether or not the Fed ought to cease elevating charges due to the monetary turmoil, and futures markets recommend that many merchants imagine it may start reducing charges earlier than the tip of the yr.

On Friday, traders continued to pummel the shares of regional financial institution shares. First Republic’s inventory is down greater than 80 % for the yr, and different regional banks like Pacific Western and Western Alliance have misplaced greater than half their values.

Traders, in different phrases, are removed from satisfied that the disaster is over.

[ad_2]

Source link