[ad_1]

Synthetic intelligence is probably each an awesome alternative and an awesome problem for wealth administration within the years forward, however can people and AI work in concord?

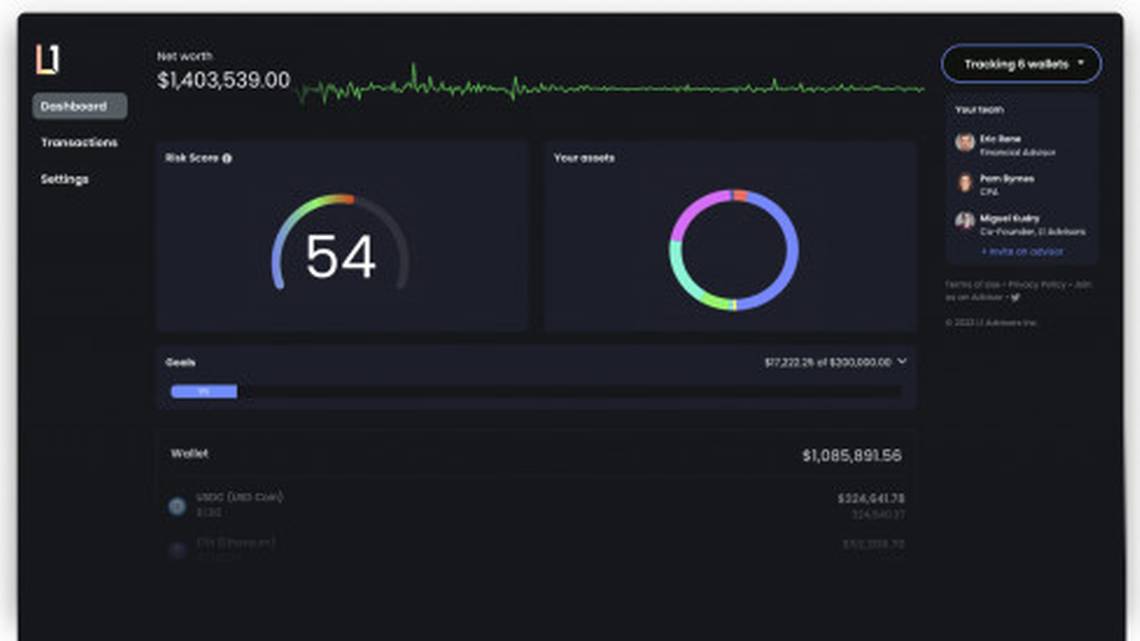

Savvy Wealth definitely believes that the burgeoning know-how is the longer term for contemporary advisors and has launched its new, absolutely built-in AI-powered advisor platform to boost the each day workflow of advisors serving high-net-worth shoppers.

From a user-friendly dashboard, advisors can handle the automation of some key parts of working their enterprise together with new account onboarding, consumer portfolio suggestions, ongoing monetary planning, and customized communications throughout a number of advertising channels.

Savvy Wealth is the guardian firm of nationwide RIA agency Savvy Advisors, and its founder and CEO Ritik Malhotra mentioned the corporate’s platform challenges the trade information that reveals all-in-one platforms have failed to realize important market share.

“Realizing the largely untapped potential of AI-driven effectivity, we noticed a possibility for our proficient crew to vary that narrative and construct our personal resolution from the bottom up,” Malhotra mentioned in an announcement. “Listening to our advisors, we designed our platform to eradicate the challenges brought on by fragmented know-how, double information entry, and guide workflows which have traditionally plagued advisors and hindered their development.”

PORTFOLIO BUILDING

Savvy Wealth just lately launched Savvy Direct Indexing to help advisors in constructing tax-optimized, risk-adjusted portfolios which considers shoppers ESG preferences.

The agency’s use of generative AI additionally simplifies many compliance-related processes akin to information entry, note-taking, and logging of consumer communications.

Study extra about reprints and licensing for this text.

[ad_2]

Source link