[ad_1]

This text, written by Costas Milas, Professor of Finance at our Administration Faculty, was initially printed in The Dialog:

The Financial institution of England (BoE) has been strongly criticised for failing to foretell the surge in inflation. Had it carried out so, it may have reacted extra shortly and prevented inflation from rising as high as 11% in autumn 2022.

The financial institution acknowledges this failing and has asked former Federal Reserve chairman Ben Bernanke to steer a evaluation of its forecasting fashions for each inflation and GDP development.

I’ve been doing my very own evaluation of the BoE’s report by evaluating the way it has carried out relative to different forecasting fashions. This demonstrates the dimensions of the financial institution’s failing – and it seems to have been compounded by a second error that will have made the scenario worse.

Completely different forecasting fashions

The financial institution will not be fully clear about the way it forecasts inflation, drawing on various in-house mathematical models. It additionally elements in market expectations of rates of interest and the financial institution’s judgement of the place variables equivalent to power costs and the pound are heading. In my evaluation, I consult with this as model 1.

As for the options, mannequin 2 is named a “quantile” model. It incorporates three components: a measure of whether or not the economic system is overheating, generally known as the output gap; the historical past of inflation; and the impact of quantitative easing (QE), through which central banks have tried to stimulate their economies by “creating” cash.

Mannequin 3, generally known as an econometric vector autoregressive (VAR) mannequin, seeks to completely seize worldwide results on the UK economic system. It appears to be like on the interactions between pressures within the global supply chain, the output hole, inflation and the Financial institution of England benchmark interest rate. It additionally incorporates oil prices and global geopolitical risk, which tends to be be ignored by forecasting fashions.

In the meantime, mannequin 4 is so much less complicated, wanting purely on the historical past of inflation to foretell the place it’s heading (we name this an autoregressive (AR) model).

I’ve calculated what every mannequin would have predicted for inflation between 2008 and 2023. I’ve additionally calculated a median exhibiting the mixed predictions of the fashions, since this often improves outcomes. For the sake of simplicity, I’ve centered on short-term forecasts, that means those who predict for the approaching three months (in different phrases, one quarter forward). Trying on the financial institution’s short-term forecasting is necessary since this relates carefully to its medium-term forecasts.

How they evaluate

The desk under ranks these predictions based mostly on a statistical check referred to as the root mean squared error: the nearer to a rating of zero, the extra correct the mannequin.

Inflation mannequin accuracy

Over all the 15-year interval, the BoE forecasts really high the desk. The median is just marginally behind in second place, adopted by mannequin 2.

But whenever you concentrate on the previous two years, the interval that actually issues as a result of inflation has been so excessive, a unique image emerges. Now, first place goes to mannequin 3, whereas the BoE predictions fall to 3rd place.

You get additional insights by viewing the predictions in graph type towards the trail of inflation:

UK inflation predictions 2021-23

This demonstrates the financial institution’s under-predicting of inflation in 2021 (pink line vs black line) – significantly in comparison with the worldwide VAR mannequin, in yellow.

It additionally reveals the financial institution considerably over-predicted peak inflation within the last quarter of 2022, anticipating 13.1% when it got here in at 10.8%. After making that prediction in August 2022, the financial institution raised the benchmark rate of interest by 0.5 factors when it had beforehand solely been elevating at 0.25 factors. It then raised by 0.5 factors in September and by 0.75 factors in November.

With out this over-prediction, the financial institution could not have sanctioned such panic rises. This may have put much less strain on the general public and doubtlessly made it less likely that the UK will tip into recession within the coming months.

The following graph plots the fashions’ inflation predictions since 2008. It reveals the BoE significantly under-predicted inflation after initiating QE in 2009, elevating questions on its understanding of the influence of the coverage. Observe that mannequin 2, which makes an attempt to take QE under consideration, did a significantly better job in that interval, whereas it was certainly one of a number of events when mannequin 3 was much less correct.

UK inflation predictions 2008-23

Ideas for the long run

The latest inflation data, printed on September 20, level to six.8% inflation within the third quarter of 2023. I’ve included this within the first graph above, and you may see that the BoE’s forecasts from just a few months in the past predict this pretty properly, as does mannequin 3 (the opposite fashions are over-predicting).

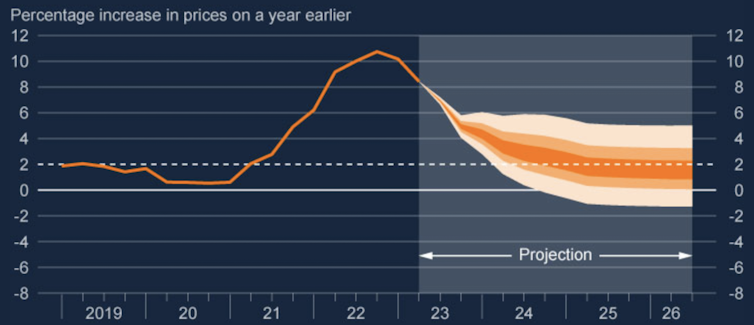

Be that as it could, the important thing level is that to foretell inflation precisely, it is very important forecast from completely different fashions and to mix forecasts. Counting on a single forecast can typically mislead and does no favours to the economics occupation. The financial institution does publish a fan chart that reveals the chance that inflation shall be above or under explicit values, however this doesn’t at all times make issues higher: when it predicted 13.1% inflation for the ultimate quarter of 2022, it hooked up a 50% chance to inflation being even greater.

Financial institution of England inflation fan chart

So the place can we go from right here? The BoE may pioneer being open about its inflation mannequin and holding a “prediction tournament” through which the mannequin’s effectiveness can be measured towards rivals.

This open-sourcing of forecasting will not be a brand new thought. Within the Nineteen Eighties and Nineteen Nineties Professor Kenneth Wallis of the College of Warwick used to run an annual conference for the Financial and Social Analysis Council, the main funder of educational financial analysis. Its purpose was to evaluate the financial forecasting fashions of assorted establishments together with HM Treasury, BoE, London Enterprise Faculty and the Nationwide Institute of Financial and Social Analysis.

Afterwards, his analysis group printed a report evaluating every mannequin. Sadly, this brainstorming exercise was discontinued in 1999. As a part of his evaluation into the BoE’s forecasting, Ben Bernanke may begin by suggesting this annual convention be revived, presumably to be held on the financial institution itself.![]()

This text is republished from The Conversation beneath a Inventive Commons license. Learn the original article.

[ad_2]

Source link